UK HealthTech: Crossing the Series A chasm

- Growth

- Article

- 4 minutes read

Fundraising is not for the faint of heart, but it does follow a familiar formula.

In general, businesses that have proven product-market fit raise money and use it to race towards their next target. Theoretically, that venture-funding process is repeated until the business is ready for IPO.

In theory, this approach is true across industries and geographies. However, I recently came across some data suggesting that the funding cycle for UK healthtech seems to stall (or shift) after Series A in the United Kingdom.

This raises two important questions: is this really the case, and if so, why does it happen?

Before we can answer, we need to first develop a basic understanding of current market dynamics.

As an American banker in London, I am regularly asked about the differences between the UK and US healthtech markets.

On the surface, they seem to be quite different. The US market is much larger, and given employer-sponsored healthcare, most of the insured population relies upon private medical insurance. Given the complexity of state and federal regulation, the result is an often personalised and hyper-competitive healthtech landscape.

The UK presents a different challenge. The market is smaller, while the National Health Service (NHS) offers universal healthcare; while health technologies often develop to either streamline access to the NHS or support personalised care to stay out of the NHS. This means that the road to launching a viable product brings a different kind of complexity.

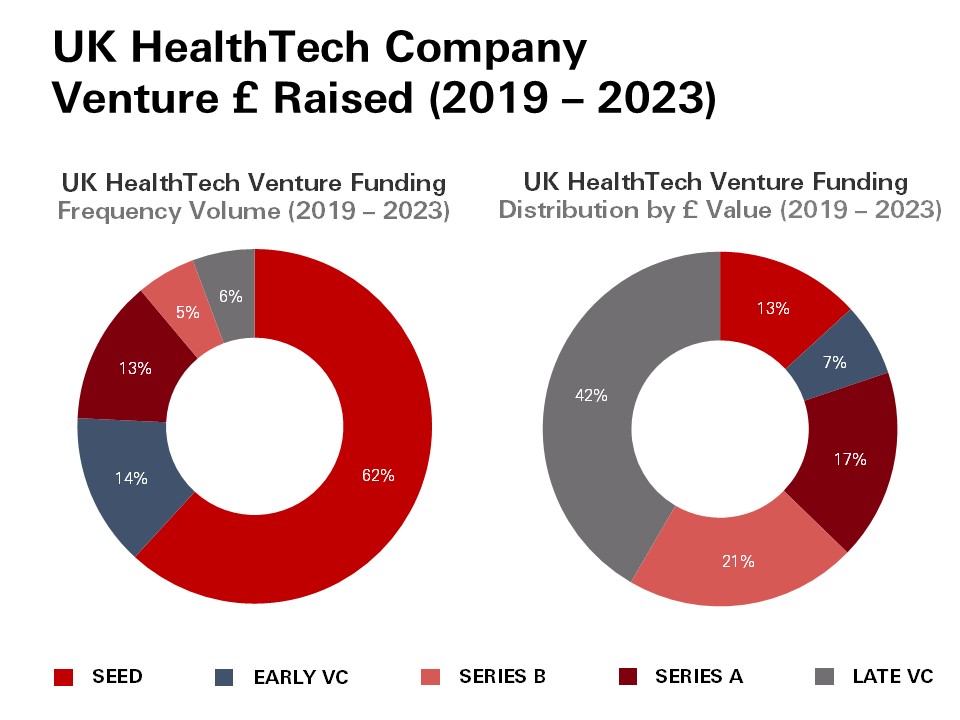

Despite these two frameworks, the question becomes one of reliable funding pathways. The UK data reflect significant volume at early stages (Seed – Series A), with just 11% of Series B and Late VC funding combined.

UK HealthTech Company Venture £ Raised (2019 – 2023)

And even with that volume across stages, the UK Series B and Late VC rounds tend to be quite significant, typically attracting transatlantic investors to fill the chasm, right when these businesses have proven that they’re primed to scale.

And this isn’t a new pattern. It’s a mystery that’s been deeply embedded in the UK healthtech market, even prior to the pandemic.

Which brings us to the real question: why?

It’s likely that there are several factors driving the Series A funding chasm in the UK.

Fewer businesses to back

The reality is that not all companies make it – even those that manage to raise a significant Series B. Some will fail, while others may look to lending for growth rather than raising funding elsewhere. However, although lending is sometimes approached as a bridge to the next round, it should be largely considered alongside an equity fundraise to firmly position the company for strength.

Expanding means navigating notoriously complex markets—all healthcare is local

It is notoriously difficult expanding into the US, particularly given the competitive nature of its healthtechs market. Federal and state regulations, increased staffing costs, and even intellectual property may mean that even a promising business may not be able to make that scalable leap forward.

It’s a challenge that goes both ways: US-based healthtechs must shift their pitch (and often partner) when hoping to either sell into or work around the NHS.

Shifting market tradewinds

Growth funding, beyond Series A and B, does represent the next step in the traditional fundraising journey, and can often be about setting up for exit or sale. However, with the IPO window only slowly opening (and in the wake of some healthtech companies delisting), select investors may have held off until the path to long-term returns becomes clear.

So where does this leave ambitious healthtech founders?

"Innovation is the ability to see change as an opportunity – not a threat."

Steve Jobs’ wise words ring true for founders asking “What’s next?” following the Series A.

While market conditions continue to dictate a focus on efficiency, there are promising signs of imminent opportunity. Investors have a record level of dry powder to deploy1 – and last year, there was active interest in breakout stage investment which read 110% of pre-pandemic levels2.

That’s music to the ears of high-quality ventures in the healthtech space who have proven their resilience – making themselves even more appealing to investors.

The question, then, shouldn’t be why there’s a chasm – but how best to view it. For founders, the funding chasm isn’t cause for concern, but rather, proof that there are many roads that lead to exciting new markets, and even to exit.

For investors, there is a crop of exciting, established companies looking to scale and speed, and the funds available to back them. That means it’s arguably more important than ever before to enrich transatlantic, cross-fund relationships to position portfolio companies long-lasting support. The Department of Business & Trade can be an invaluable partner, amongst others across the innovation ecosystem.

Perhaps, with market conditions shifting, and an appetite to deploy dry powder, healthtech won’t need to mind the gap much longer.

To explore the findings in full, please download our short report.

Download the short report